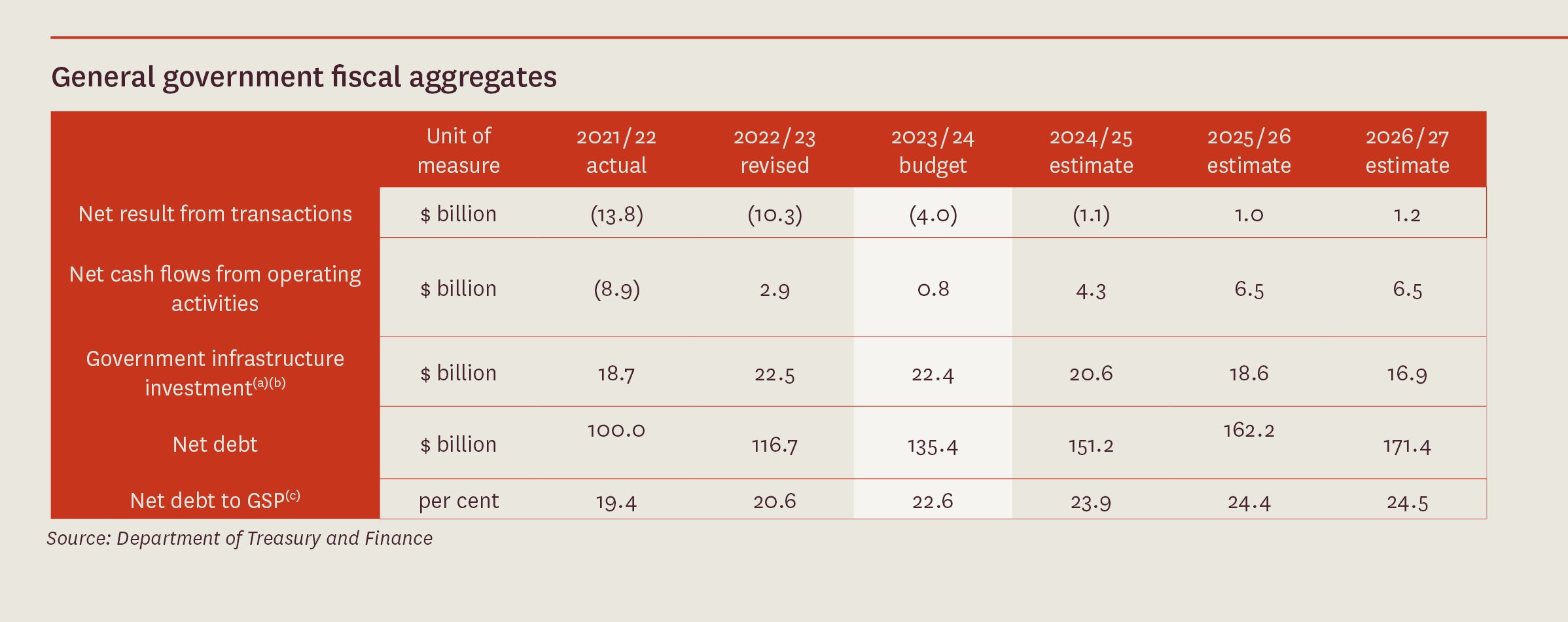

The Victorian State Budget for the 2023-2024 year (Budget) brings with it a range of state taxation measures aimed at reigning in the Victorian Government’s surging debt, currently projected at $135.4 billion for the 2023-2024 tax year and set to grow to an “eye-watering” $171.4 billion in the 2026-2027 tax year:

While the news is mostly bad for Victorian businesses, property investors and high-fee non-government schools, there is some good news for small businesses, special disability trusts and pensioners.

THE GOOD

Business insurance duty to be abolished

Business insurance duty is to be abolished over a 10-year period commencing on 1 July 2024.

The current rate of duty of 10% is slated to decrease each year by 1%.

Payroll tax-free thresholds increased

From 1 July 2024, the payroll tax threshold is to be increased from the current $700,000 tax free threshold to $900,000.

From 1 July 2025, the payroll tax threshold will increase to $1 million. That is, from that date, businesses that pay wages of less than $1 million will not pay payroll tax.

Upfront land transfer (stamp) duty abolished on commercial and industrial properties and replaced with additional land tax

From 1 July 2024 upfront land transfer (stamp) duty is not payable on commercial and industrial properties.

The first purchaser of such commercial and industrial properties will have the option to pay the duty upfront or over fixed instalments (plus interest) over 10 years equal to duty payable. From that time onwards, that property will never be subject to land transfer duty on future purchases.

Instead, once the relevant property passes the 10-year mark (ie from the date of purchase after 1 July 2024) an annual additional land tax will apply. The annual land tax is proposed to be 1% of the unimproved value of the land. This will be on top of “normal” land tax payable on that land.

While this will lower the cost of acquiring commercial and industrial properties, it will increase their holding costs.

Expanded discretion for land tax exemption for principal place of residence under construction or renovation

The Commissioner of State Revenue will be provided the discretion to extend the land tax exemption for principal places of residence under construction or renovation where the builder goes into liquidation.

Land tax exemption and duty concessions for housing for persons with disabilities

New land tax exemption for land owned by an immediate family member and used as the home of an individual eligible to be a beneficiary of a special disability trust (including where a special disability trust has not been established).

New land transfer (stamp) duty concession for the transfer of a home valued up to $1.5 million by an immediate family member to an individual eligible to be a beneficiary of a special disability trust.

The deduction threshold for the land transfer (stamp) duty special disability trust concession will increase from $500,000 to $1.5 million for principal place of residence transfers.

Pensioner duty exemption and concession thresholds increased

The pensioner duty exemption threshold has been increased to $600,000 and the concession threshold has been increased to $750,000.

THE BAD

Land tax thresholds lowered

From 1 January 2024, the current land tax free threshold of $300,000 will be reduced to $50,000. While said to be “temporary” this is currently set to be in place for 10 years.

Wagering and betting tax rate increased

The wagering and betting tax rate will increase from 10% to 15% of net wagering revenue from 1 July 2024.

THE UGLY

New land tax surcharge and increased land tax rates

Landowners will be levied with an additional land tax surcharge (in addition to land tax) “temporarily” set for the next 10 years. The rate of land tax for landowners will also increase for certain landowners (depending on the taxable landholdings).

This amount is payable on top on the “normal” land tax payable.

Details on the new land tax surcharge and increased land tax rates are shown below:

General land tax rates

For taxable landholdings between $50,000 and $100,000 — a $500 flat surcharge will apply

For taxable landholdings between $100,000 and $300,000 — a $975 flat surcharge will apply

For taxable landholdings over $300,000:

a $975 flat surcharge

an increased rate of land tax by 0.10 percentage points.

Trust surcharge land tax rates

For taxable landholdings between $50,000 and $100,000 — a $500 flat surcharge will apply

For taxable landholdings between $100,000 and $250,000 — a $975 flat surcharge will apply

For taxable landholdings over $250,000:

a $975 flat surcharge

an increased rate of land tax by 0.10 percentage points.

New payroll tax surcharge

A “temporary” payroll tax surcharge will apply until 30 June 2033 as follows:

Businesses that pay wages over $10 million a year: 0.5% payroll tax surcharge

Businesses that pay wages over $100 million a year: 1% payroll tax surcharge

Absentee owner surcharge increased

The absentee owner surcharge will increase from 2% to 4%.

The minimum threshold for non-trust absentee owners will decrease from $300,000 to $50,000.

The threshold for an absentee trust remains unchanged at $25,000.

Payroll tax-free thresholds phased out

From 1 July 2024, the payroll tax-free threshold deduction will be phased out for every dollar of wages above $3 million.

For businesses with wages above $5 million, there will be no benefit from deductions associated with the payroll tax-free threshold.

Payroll tax exemption for high-fee non-government schools removed

From 1 July 2024, the payroll tax exemption for “high-fee” non-government schools will be removed.

***

If you have any questions in relation to these Budget announcements or any state taxation matter, please contact our state taxes specialist team:

Thomas Abraham

Senior Associate

M +61 401 387 451 | T +61 3 9611 0178

E tabraham@sladen.com.au

Phil Broderick

Principal

M +61 419 512 801 | T +61 3 9611 0163

E: pbroderick@sladen.com.au